$2.68 Billion Exits Crypto Exchanges

Supreme Court Clears US Sale Of Silk Road Bitcoin, FTX Creditors To Receive Refunds

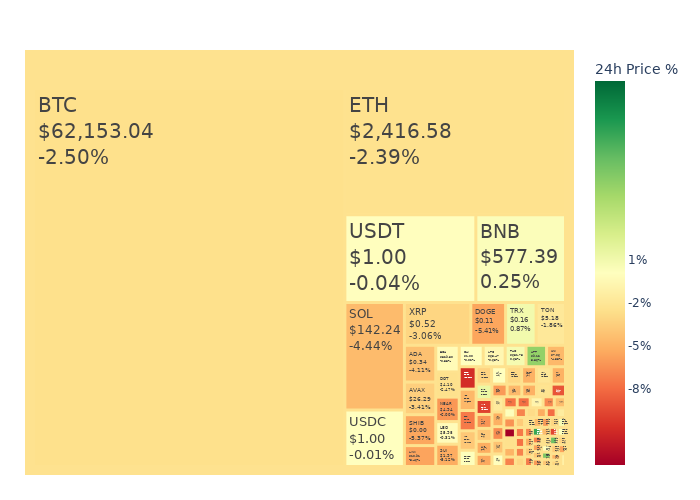

Crypto exchanges saw capital outflows totaling $2.86 billion over the past month, with stablecoins leading.

According to Defillama's CEX transparency dashboard, 9 out of 10 monitored exchanges had negative inflows.

Nansen's data shows stablecoin balance has declined from $38.5 billion to $35 billion. This could signal that investors aren't adding to their portfolios.

BlackRock's Bitcoin ETF has had 256 Bitcoin withdrawn, according to CryptoQuant.

While stablecoin outflows and Bitcoin balances declining in ETFs tell that October might not show significant gains, analysts seem to think Q4 will be positive for Bitcoin.

Market Update

News

Supreme Court Clears US Sale of Seized Silk Road Bitcoin

The recent decision by the US Supreme Court has paved the way for the sale of a massive amount of Bitcoin seized from the infamous Silk Road marketplace. In 2013, the US government seized 69,370 Bitcoin from the marketplace, which is now valued at approximately $4.4 billion. | Read More

FTX Creditors to Receive Major Refunds in New Plan

The United States court has given the green light to FTX's restructuring plan, which aims to distribute between $14.7 billion and $16.5 billion to creditors. This plan has garnered support from 94% of the creditors, covering 98% of those affected. Customers are expected to recover about 119% of their account value. | Read More

ZachXBT Recovers $275K Stolen From Elderly Victim

Recently, an elderly U.S. citizen fell victim to a sophisticated scam where fraudsters posed as Coinbase support. They tricked the victim into transferring 15 Bitcoin. ZachXBT played a crucial role in recovering the stolen funds. His investigation revealed that the scammers laundered the money. | Read More

Hong Kong To License More Crypto Exchanges By EOY

The Securities Futures Commission (SFC) has announced plans to grant licenses to 11 VATPs by the end of the year. Currently, 16 companies are awaiting decisions on their licensing applications. The comes in the wake of a $165 million scandal involving the JPEX exchange. | Read More