87% of BTC Addresses in Profit

MicroStrategy Buys 11,931 More Bitcoin, Solana ETF In The Works

On average, investors are seeing unrealized gains of around 120% following a rally in March that put Bitcoin's price an an all-time high.

Right now, the prices are quite stagnant, although the address-in-profit numbers are still very strong.

The core metric this is profitability measured with is Market Value to Realized Value (MVRV), which is above the yearly baseline.

A high MVRV indicates that most investors are holders sitting on big unrealized gains, which is regarded as a positive despite the short-term volatility the market's experiencing.

However, there has been a sizable reduction in Bitcoin trading activity, with fewer day traders resulting in market stagnation.

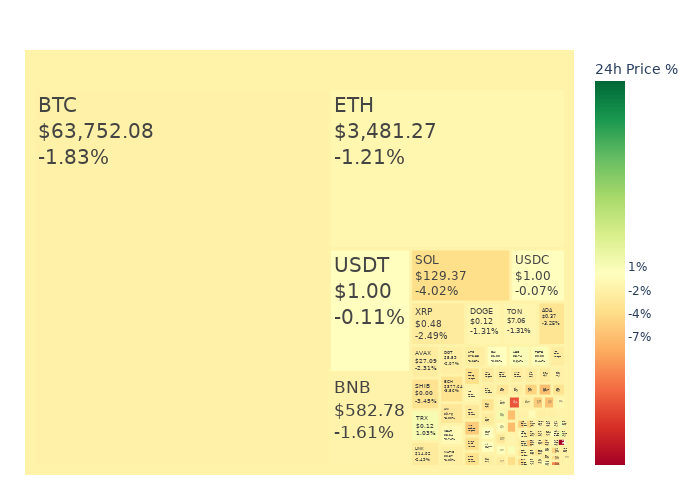

Market Update

News

MicroStrategy Buys 11,931 Bitcoin for $786 Million

To finance the recent Bitcoin purchase, MicroStrategy issued $800 million in convertible notes. These notes are unsecured and bear an annual interest rate of 2.25%. They are set to mature in 2032. Convertible notes are a type of debt security that can be converted into a predetermined number of the issuing company's shares. | Read More

Coinbase Lists EigenLayer At $12.2B Valuation

Coinbase's pre-launch trading feature is a significant aspect of this listing. It enables users to trade futures contracts on tokens before they are officially launched. For EigenLayer, this means that traders can engage in trading EIGEN-PERP (a perpetual futures contract) with up to 2x leverage. This feature is available to users in eligible jurisdictions outside the US, UK, and Canada. | Read More

3iQ Files for North America's First Solana ETP on TSX

3iQ is making headlines with its recent filing to launch North America's first Solana ETP on the Toronto Stock Exchange. 3iQ is no stranger to pioneering in the crypto ETF space. The company previously launched Canada's first Bitcoin and Ether funds, setting a precedent for innovative financial products. | Read More

Kraken Faces Uphill Battle in SEC Lawsuit Over Digital Assets

The continuing SEC's lawsuit against Kraken centers on whether the digital assets offered on Kraken's platform can be considered investment contracts. According to the SEC, Kraken's asset-specific web pages promote these assets in a way that could influence their prices, which they argue qualifies them as securities under the Howey test. | Read More