ASX May Approve Bitcoin ETFs This Year

Ethereum Fees Hit A 6-Month Low, Solana DePIN Project Io.Net Suffers From GPU Spoofing Breach

The Australian Securities Exchange (ASX), the largest stock exchange in the country/continent, could approve multiple spot Bitcoin ETFs this year, following the greenligths and launches of the US and Hong Kong ETFs.

This is not the first attempt at Bitcoin ETFs in Australia—2 were launched on CBOE Australia almost 2 years ago, but one got delisted.

U.S. Bitcoin ETFs have collectively seen around $53 billion in assets under management (AUM) since their launch, which must have been a great inspiration for Hong Kong and Australia.

Crypto management firm Monochrome's CEO Jeff Yew expects Australian Bitcoin ETfs to bring $3-4 billion in net inflows in 3 years.

The Australian Taxation Office, according to Yew, said there's already $1 billion of crypto in exchanges where the holder majority is self-managed super fund (SMSF) investors.

Ex-Binance Jeff Yew also said he expects his firm Monchrome's own Bitcoin ETF application to be approved by CBOE within the next few weeks.

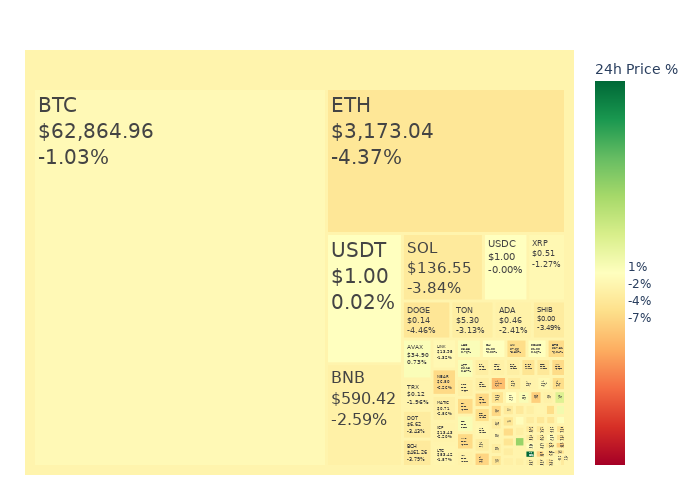

Market Update

News

Ethereum Transaction Fees Drop To 6-Month Low

Ethereum's transaction fees, commonly referred to as gas fees, have reached their lowest level since October, averaging around $1.12 per transaction. This coincides with upgrades such as the Dencun upgrade, which have enhanced the network's capacity and efficiency. These upgrades are part of Ethereum's ongoing efforts to solve scalability issues and reduce transaction costs. | Read More

Shibarium Network Set for Major Upgrade on May 2

The upcoming Shibarium hard fork is designed to significantly improve the user experience. One of the primary enhancements includes increasing the speed of transactions. Another critical aspect of the upgrade is the stabilization of transaction fees. The development team has projected that the fees could be as low as 0.0000219 BONE ($0.00001). | Read More

Solana-based DePin Project io.net Thwarts GPU Spoofing Attack

The attack involved approximately 1.8 million fake GPUs that were created to exploit the reward system designed for genuine network participants. By creating these fake GPUs, the attackers could simulate a higher contribution to the network, earning rewards that they were not entitled to. io.net's took swift action to restore normal operations. The CEO confirmed that the network is now fully operational and emphasized that the incident would not impact the scheduled product releases. | Read More

Franklin Templeton Brings P2P Features To Its FOBXX Fund

One of the most notable recent developments is Franklin Templeton's proposal for a spot Ethereum ETF, which has been listed on the Depository Trust & Clearing Corporation (DTCC) website with the ticker EZET. Another groundbreaking development by Franklin Templeton is the integration of peer-to-peer (P2P) functionality into its Franklin OnChain US Government Money Fund (FOBXX). | Read More