Bitcoin Miners' Historic 30K BTC Sell-Off

The Vatican Library Turns To Blockchain For Manuscript Preservation, Ethereum Gas Fees At Record Lows

30,000 Bitcoins worth around $2 billion have been sold by Bitcoin miners in June alone - the fastest pace in a year ever. Reported by IntoTheBlock.

At the start of June, miner reserves were stood at over 1.94M BTC, and now are at around 1.91M BTC. This includes the reseves of large and prominent pools Viabtc, Antpool, Binance, Bitfury, Bixin, and Poolin.

The Bitcoin reserves of miners have hit the the lowest level in over 14 years.

One of the main drivers of the sell-off is the even further reduced miner revenue following the recent Bitcoin halving event.

The halving on April 20 dropped the mining rewards from 6.25 BTC to 3.125 BTC.

The rapid selling is very uncommon, as miners are relatively known to sell their reserves rather slowly.

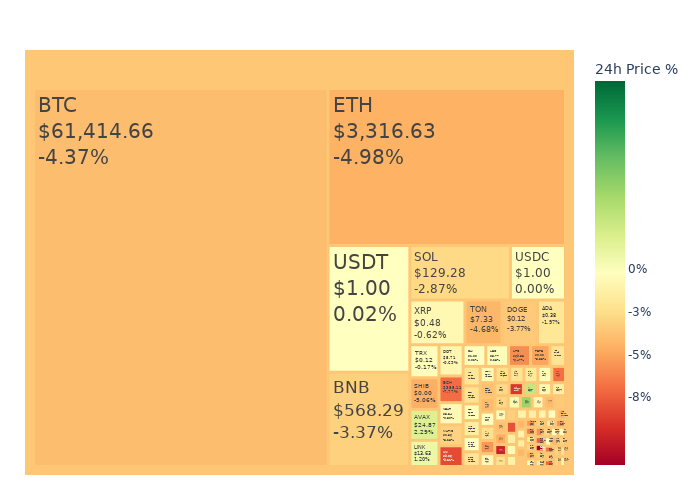

This development comes during (and adds to) Bitcoin's still-ongoing price decline, dragging altcoins behind.

Market Update

News

Private Blockchains Handle Over $1.5T of Securities Financing Monthly

Private blockchains are quietly revolutionizing the world of securities financing, handling over $1.5 trillion worth of transactions every month. This significant volume surpasses the much-publicized tokenization of real-world assets on public blockchains like Ethereum. | Read More

Vatican Library Embraces Blockchain for Manuscript Preservation

"Vatican Library Web3 Support Project," is a collaboration with NTT DATA Italia. The project aims to make historical texts more accessible and foster a global online community. The Vatican Library is distributing NFTs to donors and social media users. These NFTs are unique digital assets that cannot be transferred or sold, known as soul-bound NFTs. | Read More

21Shares Launches Ethereum Staking ETP on London Stock Exchange

21Shares has recently launched an Ethereum Staking ETP, known as AETH, on the London Stock Exchange. Prior to its listing on the London Stock Exchange, AETH was already available on other major exchanges such as Nasdaq, SIX Swiss Exchange, and Deutsche Boerse Xetra. | Read More

Ethereum Gas Fees Plummet to Record Lows

Ethereum's average gas fees have dropped to under three gwei, marking the lowest point in years. This significant reduction in fees comes despite the network experiencing record-high activity. The decrease in gas fees is a result of more efficient fee markets, largely due to increased transactions on layer 2 protocols and the EIP 4844. | Read More