Decoding Curve's $70M Hack

The Emerging Ethereum Layer 2 Race, Grayscale's Challenge to the SEC, and Bitcoin's Bullish Future: Unpacking the last weekend in Crypto!

Welcome to Daily Digest, where we surface trending news in crypto-based on conversations we found on Twitter, news publications, blog posts, and other social media, powered by the Coinfeeds platform.

Here are the trending news items over the last 24 hours. If you’d like to see it’s realtime updated version, head over to our website here

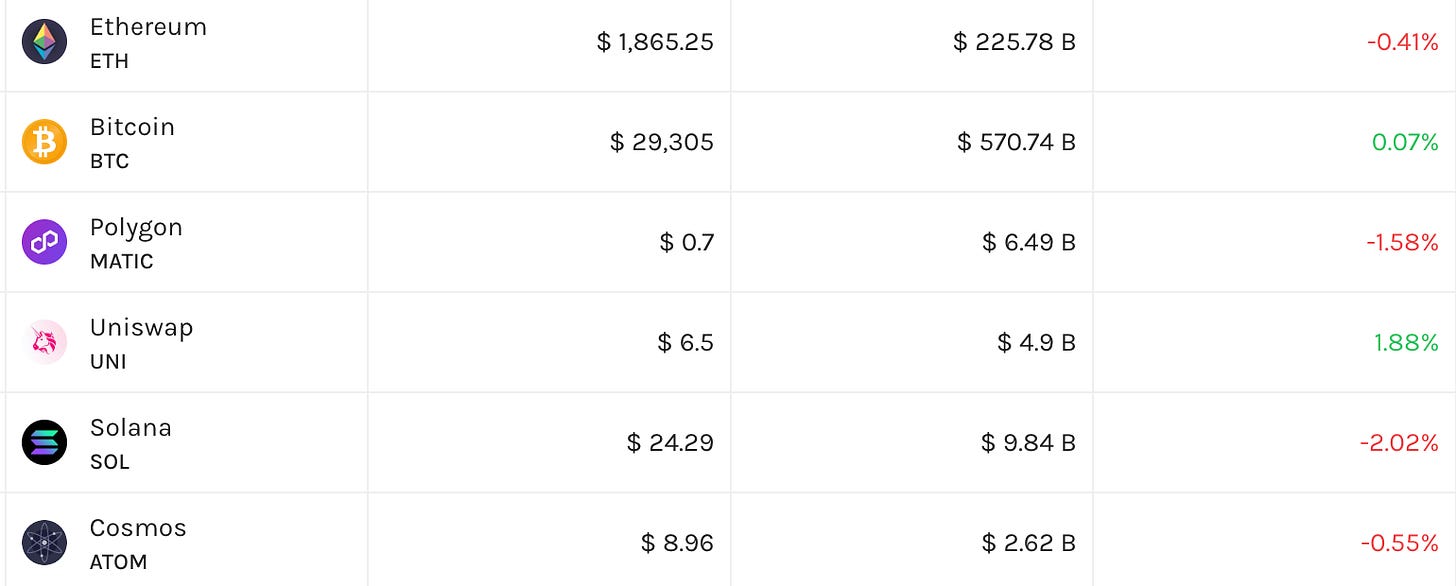

Market Updates

Deep Dive - Curve Finance Pools Exploited

Several DeFi protocols built on Vyper including Curve, Alchemix, and JPEG'd were exploited in July 2023, draining over $70 million due to reentrancy attacks targeting Curve, Alchemix and JPEG'd. The hack led to volatility in CRV and spikes in borrowing fees as lenders pulled funds. However, damage was limited since Curve's CRV/ETH pool was not used as an on-chain oracle.

What is a reentrancy attack and how does it affect smart contracts?

Let's use a real-world analogy of a cinema to explain reentrancy attacks. Let's say you're at a cinema to see a movie. You buy a ticket at the counter and the cashier marks you off the list of ticket holders. Now, the process should be that you hand over your ticket, go through the door, and then the door gets locked. But in a reentrancy attack, it's as if you've fooled the cashier into letting you back into the queue to buy another ticket before they've had a chance to cross you off their list. You could then repeat this process, getting more tickets without actually paying for them.

In Ethereum, this can happen when a smart contract sends Ether to an external contract before it's had a chance to update its internal state. A malicious contract could then repeatedly call the vulnerable contract and drain it of its Ether.

What is Vyper and what is its relationship to Ethereum?

Vyper is a contract-oriented programming language designed for Ethereum Virtual Machine (EVM), which is used to execute smart contracts on the Ethereum network. It is designed to be secure, simple, and easy to audit, with its syntax and fewer features making it a great choice for quick prototyping and efficient use of resources. Vyper is often used as an alternative to Solidity, another popular language for writing smart contracts on the Ethereum platform.

What is crvUSD and how does it work?

crvUSD is a decentralized stablecoin issued by Curve Finance, a prominent DeFi protocol. It's pegged to the U.S. dollar and uses an over-collateralized structure, meaning it can only be minted by posting collateral in supported cryptocurrencies. It employs a Lending-Liquidating AMM Algorithm (LLAMMA) which liquidates portions of the collateral as the price falls, ensuring enough crvUSD to cover the loan value. For instance, staked ether (stETH) holders can use their tokens to mint crvUSD. The value of minted crvUSD will be a portion of the stETH's value. The crvUSD is controlled via smart contracts and backed by a basket of tokens, maintaining its full backing at all times.

What are stable pools?

Stable Pools are a type of liquidity pool used in decentralized finance. They are designed for trading like-kind assets which typically have a low price impact. This type of pool is particularly useful for stablecoins, which aim to maintain a consistent value. In a Stable Pool, anyone can pair these like-kind assets and become a market maker, contributing to the overall liquidity of the platform. The goal is to facilitate efficient trading between stable assets with minimal price slippage.

News

Sam Bankman-Fried's Legal Troubles

The U.S. Department of Justice (DoJ) has urged federal judge Lewis Kaplan to revoke FTX founder Sam Bankman-Fried’s bail, arguing that he has flouted even the increasingly strict conditions placed on him multiple times. Prosecutors accuse Bankman-Fried of intimidating witnesses and attempting to influence their testimony. The issue of his bail arose after he shared personal Google documents with a reporter from the New York Times. Prosecutors argue that Bankman-Fried's actions amount to witness tampering. Bankman-Fried has pleaded not guilty to stealing billions of dollars in FTX customer funds.

Shiba Inu's Anticipated Shibarium Launch

Shiba Inu whales have accumulated over 1 trillion SHIB tokens in anticipation of the Shibarium launch, helping prices rise. The Shibarium Beta Bridge allows seamless asset transfers from Ethereum to Shibarium, offering faster transactions, lower fees, and connections to the Ethereum network. The public beta testing is a precursor to the upcoming launch of the Shibarium Layer-2 mainnet. The rally is attributed to the launch of the Shibarium beta bridge, which has seen a surge in price and has become one of the top gainers in the last 24 hours.

Bitcoin's Bullish Outlook

Bitcoin long-term holders are demonstrating low selling pressure, indicating a robust bullish outlook for the cryptocurrency. Around 71% of Bitcoin's realized capitalization has remained unmoved for over six months, suggesting that long-term holders are not rushing to sell their holdings. This reduced selling pressure is seen as a positive sign for investors and enthusiasts. US Congressman Patrick McHenry describes Bitcoin as a "financial revolution" and believes that the next wave of internet technology will be built using blockchain and cryptocurrencies.

Crypto-related Crimes and Security Issues

An elderly couple in North Carolina was held hostage in their home by armed men who threatened them before robbing them of over $156,000 in cryptocurrency. Several decentralized finance protocols were targeted by attackers who exploited a vulnerability in liquidity pools on the Curve platform, resulting in the theft of over $24 million worth of cryptocurrency. The hacker stole 7 million CRVs and $14 million worth of WETH, leading to a temporary drop in the price of CRV to $0.1.

Bitcoin Spot ETFs and the SEC

Grayscale, a leading crypto fund manager, has urged the U.S. Securities and Exchange Commission (SEC) to approve all pending spot Bitcoin exchange-traded funds (ETFs) simultaneously. The company argues that selective approval would give unfair advantages to certain proposals. The SEC recently lost a lawsuit related to the regulation of SPIKES futures, a volatility index product. This decision has implications for Bitcoin ETFs and the legal battle between Grayscale and the SEC. The impending Bitcoin spot ETF, spearheaded by BlackRock and others, is on the horizon, bringing both excitement and apprehension.

Cryptocurrency Adoption by Traditional Institutions

Acclaimed actress Margot Robbie shared an anecdote about her husband's interest in Bitcoin, coining the term "Big Ken Energy." The British Museum has partnered with The Sandbox, a player in the crypto and metaverse scene, to embrace digital collectibles. This marks a new direction for the museum as it transitions into digital experiences. Ducati has partnered with XRP Ledger to launch its first-ever NFT collection. The collection will feature a video sequence of all the Ducati logos that have appeared on their motorcycles since 1946.

Ethereum Layer 2 Developments

Optimism (OP) is gaining ground on Arbitrum (ARB) in daily transactions, signaling a potential shift in the race for the best Ethereum Layer 2 network. Optimism's growth can be attributed to its OP stack, which allows users to build their own chain. The competition between the two networks has intensified with the launch of Mantle mainnet, which also utilizes the OP stack. Other contenders in the Ethereum Layer 2 race, such as zkSync Era, Starknet, and ImmutableX, are also showing support for Optimism.

Regulatory Actions on Cryptocurrency

Elizabeth Warren has reintroduced a crypto bill with the backing of the banking policy group, the Bank Policy Institute (BPI). The legislation aims to crack down on the use of cryptocurrencies in illicit finance, money laundering, drug trafficking, and financing terrorism. The SEC asked Coinbase to halt trading in everything except bitcoin, according to CEO Brian Armstrong.

As always, stay tuned for more updates in crypto!