Ethereum ETFs Debut

BTC Miners Return To Profitability, Ferrari Expands Crypto Payments To Europe

Following the SEC’s approval, spot Ethereum ETFs started trading on U.S. stock exchanges yesterday and saw $1 billion in trading volume on the first day.

For reference, Bitcoin ETFs saw $4.5 billion in trading volume on launch day in January. Ethereum ETFs seeing a fraction (~20%) of Bitcoin ETF volumes was expected.

SoSoValue's tracker showed a net inflow of $106.7 million of this $1.077 billion sum.

The ETFs came from 9 firms, and had different trading volumes: Grayscale ($461M), BlackRock ($244.7M), Fidelity ($138M), Bitwise ($100M), VanEck ($45M), Grayscale mini ($63.8M), Franklin ($15.9M), Invesco ($12M), 21Shares ($8.6M).

Investors can access over 70% of the liquid cryptoasset market through these ETPs, as per Bitwise Matt Hougan's comments.

This comes following the approval of S-1 forms for Nasdaq, NYSE Arca, and CBOE launches, and the asset managers waiving ETF fees for a limited period.

The price of Ethereum itself remained stagnant and hasn't seen surprising volatility.

Following the launch and the market reactions, investors and enthusiasts are shifting their focus on Solana and other altcoin ETFs.

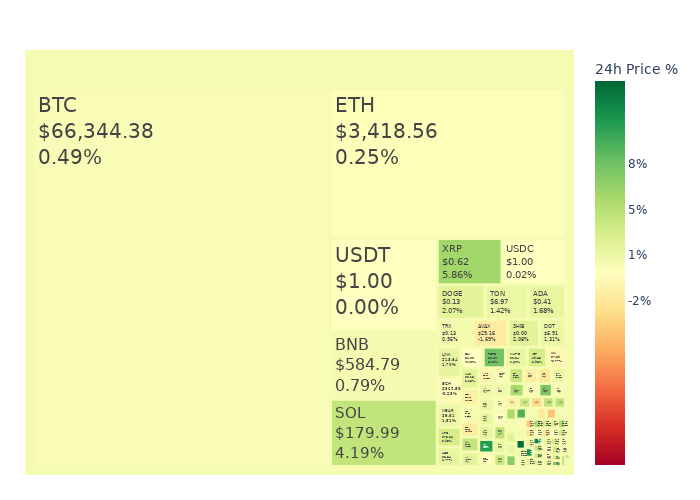

Market Update

News

Bitcoin Miners Return to Profitability Amid Market Recovery

Bitcoin miners are experiencing a return to profitability as the market value of Bitcoin continues to recover. This positive trend is highlighted in a recent report by Bitfinex exchange, and marks the first time in a month that Bitcoin miners have been profitable. The losses began following the Bitcoin halving in mid-April, which reduced the miner rewards. | Read More

Ferrari Expands Cryptocurrency Payments Across Europe After US Launch

Starting from the end of this month, Ferrari's European dealers will begin accepting payments in cryptocurrency. This initiative is part of Ferrari's broader strategy to meet the evolving needs of its clients. By the end of 2024, Ferrari plans to further extend cryptocurrency transactions to other countries. | Read More

DYdX in Talks to Sell v3 Trading Platform to Crypto Market Makers

DYdX Trading Inc., a prominent player in the DeFi sector, is currently in discussions to sell its v3 derivatives trading software to a group of leading crypto market makers. Potential buyers include Wintermute and Selini Capital. This is following dYdX’s announcement saying that v3 has been compromised. | Read More

HSBC to Block Crypto Payments in Australia from July 2024

Starting from 24 July 2024, HSBC will block all payments to crypto exchanges in Australia. This decision is part of a broader effort to protect customers from scams. According to HSBC, Australians lost over $171 million to investment scams last year. The decision has sparked discussions about whether outright bans are the most effective way to protect customers. | Read More