Ethereum Fees Dropped Below 1 Gwei

Record Withdrawals In Ethereum Staking, Aave Saw $300M In Liquidations

For the first time in 4 years, Ethereum gas fees (avg) have dropped below 1 Gwei, then jumped back up to ~2 Gwei ($0.06).

The drop has been noticed across different Ethereum L2 scaling solutions, including Optimism, Base, Arbitrum, and Linea. Fees there are now under $0.01.

The drop could be due to the introduction of blobs from the Dencun upgrade released in March that made L2 transaction volumes soar.

According to L2Beat, L2s like Base and Arbitrum are now processing more transactions than Ethereum.

The decline in gas has led to a supply increase, given less active ETH burning (120 ETH burned, 2,500 ETH added to supply in the past day). if the plummeting of Ether fees continues, the supply could expand by ~943,000 ETH next year.

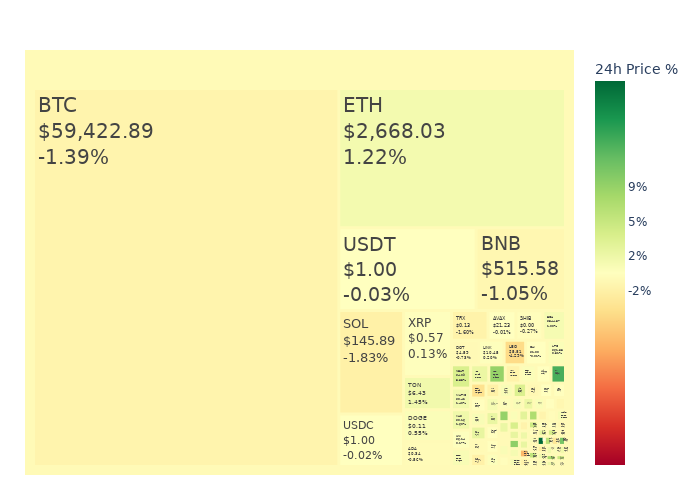

Market Update

News

Ethereum Staking Sees Record Withdrawals This Week

Ethereum staking has experienced a significant increase in withdrawals, with over 122k ETH unstaked this week, marking the largest withdrawal since May. This trend was highlighted by IntoTheBlock's Staking Flow Indicator, which tracks the daily flow of ETH in and out of staking pools. | Read More

The Tether v Celsius Lawsuit Over $2.4B Bitcoin Liquidation

The core of the conflict lies in Celsius Network's claim that Tether wrongfully liquidated approximately $2.4 billion worth of BTC collateral. According to Celsius, this action was not justified under the terms of their agreement. Tether argues that the liquidation was carried out with Celsius' direction and consent. | Read More

Aave Faces $300M Liquidations Amid Ethereum Price Drop

Aave recently faced a significant challenge as the price of Ethereum dropped by 25%. This event triggered nearly $300 million in liquidations, marking the largest liquidation event in Aave's history. To maintain financial stability, Aave's protocol automatically executed liquidations. | Read More

BlackRock's Ethereum ETF Nears $1 Billion Inflows in Record Time

BlackRock's Ethereum ETF, the iShares Ethereum Trust, is on track to become the first US spot Ethereum fund to reach $1 billion in net inflows. Despite ETHA's impressive growth, Grayscale's Ethereum ETF still leads in managed assets. | Read More