Fear & Greed Index At 18-Month Low

SEC's Gensler Talks Ethereum ETFs and Crypto Regulation, VanEck's New Filing Hints At Ethereum ETF Launch As Early As Next Week

Yesterday, the Crypto Fear and Greed Index, measuring the overall market sentiment starting with Bitcoin and other cryptos, has dropped to an 18-month low of 30. Today it's at 46.

The Fear zone is between 24 and 50. The index is based 25% on volatility, 25% on trading volume, 10% on Bitcoin's dominance, and 10% on trends.

Last time the index was this low was on January 11th, 2 months after the FTX collapse when Bitcoin sat at $17,200

This sentiment is amid massive outflows from Bitcoin ETFs, and largely caused by Mt. Gox potentially preparing to start repaying $8.5B of Bitcoin to creditors, and Germany selling Bitcoin reserves.

However, people like Galaxy Digital executive Samson Mow think that the market may be overreacting about the two happenings.

The uncertainties about the ongoing finalization of the Ethereum ETF launch are likely adding to the sentiment. VanEck’s just submitted a new 8-A filing causing speculation, and the SEC’s Gary Gensler publicly discussed the processes.

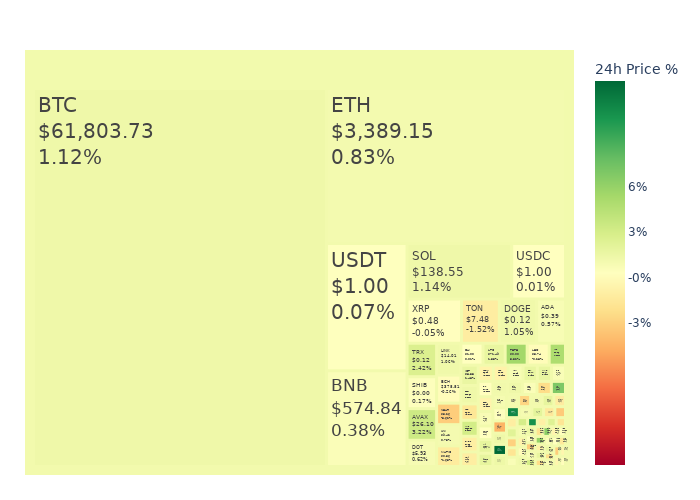

Market Update

News

SEC's Gary Gensler Speaks Out On Ethereum ETFs and Crypto

The SEC chairman Gary Gensler said at the June 25th Bloomberg conference that the launch of Ethereum ETFs is "going smoothly", discussed the regulatory landscape of crypto where there is "significant noncompliance" and where 20,000 tokens are investment contracts or securities without proper disclosures. | Read More

Linux Foundation Launches LF Decentralized Trust Initiative

The Linux Foundation has announced its intent to form the Linux Foundation Decentralized Trust. LF Decentralized Trust is an umbrella organization that will include existing Hyperledger projects and host new open-source software, communities, standards, and specifications. The goal is to create a broader ecosystem for decentralized systems of distributed trust. | Read More

VanEck's New Ethereum ETFs Filing Hints At Launch Next Week

VanEck's new filing of an 8-A form for its Ethereum Trust has set the stage for the potential launch of Ethereum ETFs as early as next week. The companies involved have been actively engaging in promotional activities and have published management fees, signaling their readiness to enter the market. | Read More

Ethereum Sees Longest Inflationary Period Since The Merge

Ethereum has recently experienced its longest inflationary period since the Merge. This period has lasted nearly 72 days, during which the circulating supply of Ethereum increased by almost 50,000 ETH. The recent inflationary period is largely attributed to the Dencun update. This update has reduced the base fees for Ethereum transactions, making it cheaper to use the network. | Read More