FTX's Bankruptcy Auction: The Crypto Market's Newest Bear Market

ZK Rollups Usher in a New Era for Bitcoin, Market Cap Tumbles, and Binance's SEC Standoff

Welcome to today's edition of Coinfeeds Daily Digest, your go-to source for the latest happenings in crypto. As the dust settles around FTX's bankruptcy filing, we delve into the ripple effects of the exchange's asset liquidation and its impact on the broader market. We also cover developments that are shaping the future of cryptocurrency, from Bitcoin's scaling solutions to the introduction of yield-bearing stablecoins.

First up, we explore FTX's shaky ground—a bankruptcy filing revealing $7 billion in assets and yet a rush to liquidate. What does this mean for the crypto market and creditors? Then, we turn our gaze to ZK Rollups, Bitcoin's much-anticipated scaling solution that promises to bundle transactions and increase network scalability.

On the stablecoin front, Mountain Protocol introduces USDM, offering non-U.S. users an attractive 5% APY. Yet, with Bitcoin experiencing a short squeeze and Vitalik Buterin's account taking a hit, the bearish sentiment doesn't seem to be going away any time soon.

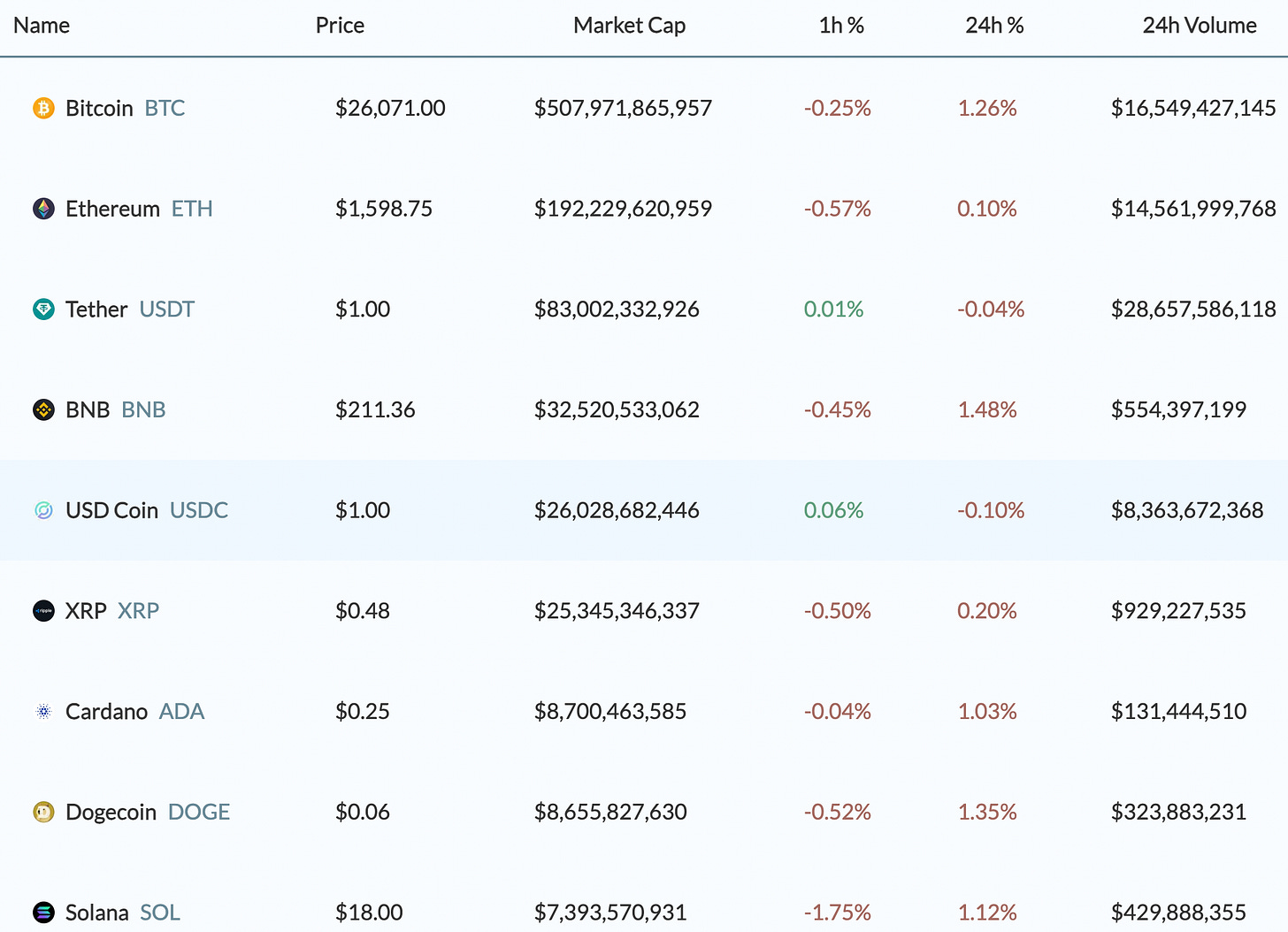

Moreover, whales are dumping Bitcoin and Ethereum, causing the total crypto market cap to slide below the $1 trillion mark for the first time in six months. Meanwhile, Binance battles with the SEC over "overbroad" deposition requests, PayPal rolls out a new crypto-for-USD conversion service, and Bitget announces a $100 million fund for ecosystem development.

For live Trending news, click here to explore.

Market Update

News

FTX's Bankruptcy and Asset Liquidation

The bankrupt cryptocurrency exchange FTX has amassed around $7 billion in assets, including $1.16 billion in solana (SOL) tokens and $560 million in bitcoin (BTC), according to a court filing. The filing also reveals billions in payments made to senior executives before the company filed for bankruptcy. FTX has secured $1.5 billion in cash and holds $3.4 billion in crypto, along with other assets such as real estate. The company's new management is attempting to reclaim funds made as donations to politicians and charitable organizations. FTX is seeking permission to sell off its crypto holdings to return funds to creditors.

The Future of ZK Rollups and Bitcoin

Recently, both Chainway and Kasar Labs, in collaboration with respective partners, made significant advancements in bringing ZK Rollups to Bitcoin. Chainway's open-source data availability (DA) adapter, designed for the Sovereign Software Development Kit, paves the way for Bitcoin's first ZK rollup. Simultaneously, Kasar Labs and Taproot Wizards introduced a DA adapter that integrates the Madara stack with Bitcoin, allowing for a Starknet-based rollup using StarkWare's Cairo programming language. These developments are poised to enhance Bitcoin's scalability and offer users increased privacy.

Mountain Protocol's Yield-Bearing Stablecoin and Seed Fundraise

Mountain Protocol has launched a yield-bearing stablecoin called USDM. The stablecoin is designed to give non-U.S. users access to U.S. Treasury yields and can be used across various DeFi protocols. It is fully backed by short-term U.S. Treasuries and provides users with daily rewards in the form of rebasing at a rate of 5% APY. The stablecoin is not available to U.S. customers and has not been registered as a U.S. security. Mountain Protocol has also announced a seed fundraise led by Nic Carter from Castle Island Ventures.

Bitcoin Short Squeeze Lifts Prices Back to $26K

Bitcoin experienced a short squeeze, causing its price to jump to nearly $26,000 and reversing the previous day's decline. This rally was driven by the unwinding of bearish derivative bets, leading to a decline in open interest and positive funding rates. However, the lack of immediate bullish catalysts may limit the price recovery. The focus has shifted to the impending liquidation of FTX's altcoin holdings, and the bearish sentiment remains as long as prices are held below the 50-day moving average.

Hack of Vitalik Buterin's X Account Leads to $691K Stolen

Hackers have stolen over $691,000 from Ethereum founder Vitalik Buterin's X account by posting a malicious phishing link that gained access to people's wallets. The stolen amount includes non-fungible tokens (NFTs). It is unclear whether Buterin was a victim of a "SIM swap" attack, but the analyst suggests that an insider could have been involved. This incident highlights the ongoing risks and vulnerabilities in the cryptocurrency space, with investors losing millions of dollars to scams and hacks.

Total Crypto market cap falls below $1 trillion as whales dump Bitcoin and Ethereum

The total market capitalization of the cryptocurrency market has fallen below $1 trillion as large investors, known as whales, have been selling off their Bitcoin and Ethereum holdings. This decline in market cap is the first time it has dropped below $1 trillion in six months. The market has been experiencing a drawdown for the past month, and recent events such as concerns over Solana and the FTX hearing have caused panic selling among investors. This has led to a significant decline in the overall value of the crypto market.

Binance Says SEC’s Request for Depositions is ‘Overbroad’ and 'Unduly Burdensome'

Binance.US has responded to the Securities and Exchange Commission (SEC), calling their request for depositions and further discovery "unduly burdensome" and lacking evidence of customer funds being wrongfully diverted. Binance denies the allegations made by the SEC and states that all evidence supports their position of having custody and control of digital assets. The SEC had sought an asset freeze on Binance.US, but the request was declined by a U.S. judge. Binance questions the extent of the SEC's requests and argues that the burden of depositions outweighs their potential benefit.

PayPal rolls out crypto-for-USD conversion service

PayPal is expanding its crypto-related services by launching an "off ramp" service that allows users to convert digital currency into dollars. This service will enable users to seamlessly convert their crypto into USD directly from their wallets into their PayPal balance, giving them the ability to shop, send, save, or transfer to their bank or debit card. The service is available to wallets, dApps, NFT marketplaces, and is live on MetaMask. PayPal's announcement follows its previous unveiling of an "on ramp" service and other crypto-related initiatives.

Bitget unveils further $100M fund for ecosystem development

Bitget, a crypto derivatives platform, has announced the Bitget EmpowerX Fund, a $100 million fund aimed at growing its ecosystem and investing in regional exchanges, analytics firms, media organizations, and entities that contribute to its growth. The fund is part of Bitget's mission to become a comprehensive platform that caters to the changing needs of crypto users. The company expects more investments, mergers, and acquisitions in the coming months as the centralized exchange landscape evolves with changing regulations. This fund follows Bitget's launch of a $100 million Web3 fund for crypto projects in Asia earlier this year.

As always, stay tuned for more updates in crypto!