Robinhood Considers Crypto Futures

Court Dismisses SEC Claims Against Binance, Aave Launches GHO Stablecoin On Arbitrum

Robinhood is reportedly planning to expand its crypto services with crypto futures in in the US and Europe.

This comes following Robinhood's acquisition of Bitstamp for $200 million, a company whose Luxembourg-based crypto licenses could open doors for crypto futures.

Robinhood is eyeing Bitcoin, Ethereum, and other token futures to offer in Europe, and CME-based ones in the US.

The acquisition of Bitstamp will help Robinhood build better crypto-focused customer experiences and usage safety, given Bitstamp's historic resilience to market cycles.

Robinhood's Q1 2024 earnings report has shown that nearly 40% of its transaction-based revenue originates from crypto trading.

In May, Robinhood launched crypto staking in Europe, primarily for Solana, and in March, Robinhood acquired Marex FCM to secure a futures license in the US.

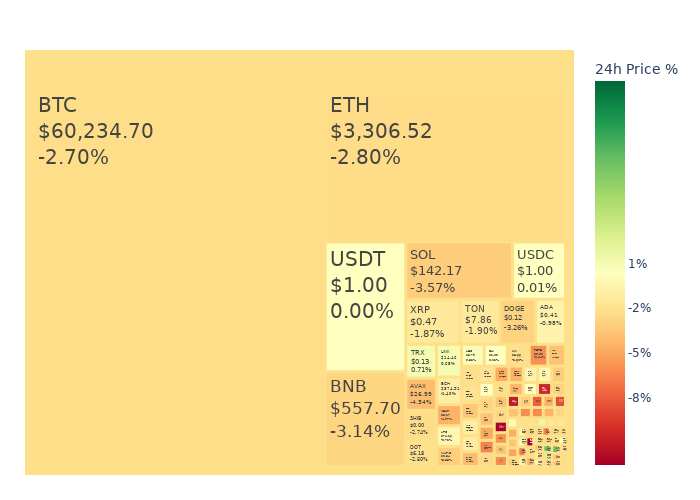

Market Update

News

Court Dismisses SEC Claims Against Binance in Landmark Ruling

A U.S. District Court dismissed three key accusations made by the Securities and SEC against Binance. The court specifically rejected the SEC's claims that Binance's BNB tokens and Binance USD (BUSD) are securities. The SEC had argued that trading these tokens on secondary markets constituted the sale of securities, which would subject them to strict regulatory oversight. | Read More

Aave Launches GHO Stablecoin on Arbitrum Network

The Aave DAO has taken a significant step forward by launching its GHO stablecoin on the Arbitrum network. This marks the first phase of Aave's ambitious cross-chain expansion strategy. GHO is a stablecoin developed by Aave, a DeFi protocol. Chainlink's Cross-Chain Interoperability Protocol plays a crucial role in this expansion. | Read More

Spot Ethereum ETFs Could Launch by Mid-July, Says Analyst

Nate Geraci, president of The ETF Institute, has indicated that spot Ethereum ETFs could be available by mid-July. Specifically, he suggests that the launch could occur during the week of July 15. This timeline is based on the SEC's recent request for ETF applicants to submit revised S-1s. | Read More

Bitfinex Securities Launches Tokenized Bonds with Mikro Kapital

Bitfinex Securities has recently launched two new tokenized bond issues in collaboration with Mikro Kapital, aiming to support microfinance projects. The new bond issues by Bitfinex Securities come with two different durations: 11 months and 36 months. The 11-month bond offers a 10% coupon rate, while the 36-month bond offers a 13.5% coupon rate. | Read More