SEC signals Ethereum is not a security

Grayscale Launches XRP Trust, Aerodrome Finance Leads On Base With TVL

The SEC has announced a settlement with eToro who have agreed to pay $1.5 billion in fines for operating as an unregistered trading platform, the details of which suggest the SEC might have changed its stance on Ethereum's classification.

eToro will have to stop offering crypto except for Bitcoin, Ethereum, and Bitcoin Cash — these are to be supervised as commodities according to signals from the settlement.

Ethereum's classification has not been made clear by the SEC for a while, even though Solana, BUSD and others have been treated s securities by SEC attorneys.

After the collapse of Terraform Labs and FTX, the SEC started going after players big and small, including the major exchanges, DEXs, and NFT projects.

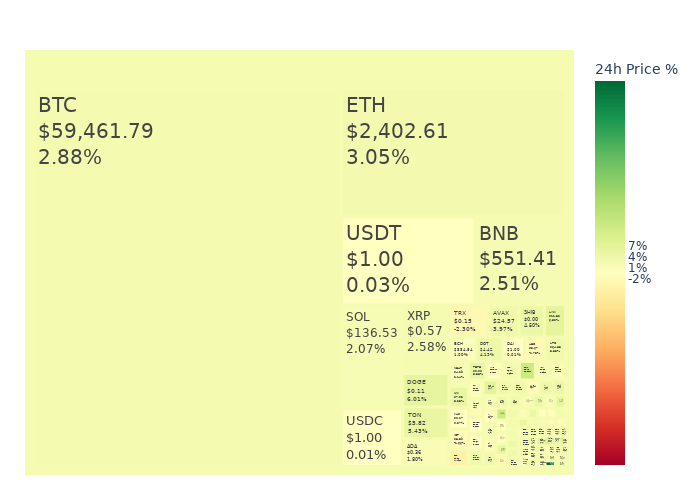

Market Update

News

Polygon PoS Leads In Tokenization Of $30 Trillion In Real-World Assets

The tokenization of RWAs on the Polygon Proof of Stake blockchain is emerging as a significant opportunity, potentially unlocking a $30 trillion market. This is gaining traction among major financial institutions, indicating a growing trust in blockchain operations. | Read More

Aerodrome Finance Leads On Base Network with $574M TVL

The total value locked (TVL) in Base protocols has reached approximately $1.43 billion, showcasing the growing adoption of DeFi solutions. Among these protocols, Aerodrome Finance stands out as a leader, with a TVL of $574 million. Aerodrome Finance's success can be attributed to its innovative core mechanism, Ve(3,3). | Read More

Grayscale Launches XRP Trust Amid Ripple's SEC Battle

Grayscale is launching a closed-end XRP trust in the United States. This new investment vehicle is designed to provide accredited investors with direct exposure to Ripple’s XRP token. This coincided with the nearing end of Ripple's legal battle with the SEC. | Read More

Deutsche Bank Survey Reveals Growing U.S. Acceptance of Crypto

The Deutsche Bank report highlights that 65% of U.S. consumers believe that cryptocurrency could replace cash in the future. Fewer than 1% of U.S. consumers consider cryptocurrency a fad, but only 18% believe that stablecoins will thrive, with 42% expecting them to fade away. | Read More