Skyscanner now has crypto payments for travel bookings

Bitcoin Network Reaches Three-Year Lows, MasterCard Launches Crypto Debit Card In Europe

Travala.com, a crypto-native travel platform, has partnered with Skyscanner to bring over 100 cryptocurrencies to the Skyscanner's hotel booking platform.

These cryptos are now discoverable on Skyscanner, and can be used to book rooms from Travala's inventory of 2.2 million hotels.

The initiative is expected to drive traffic to Travala from Skyscanner's user base of 110 million people monthly and 80 billion searches every day.

Travala will be handling the transactions after users get redirected from Skyscanner, and will offer perks like up to 10% back in Bitcoin and other rewards.

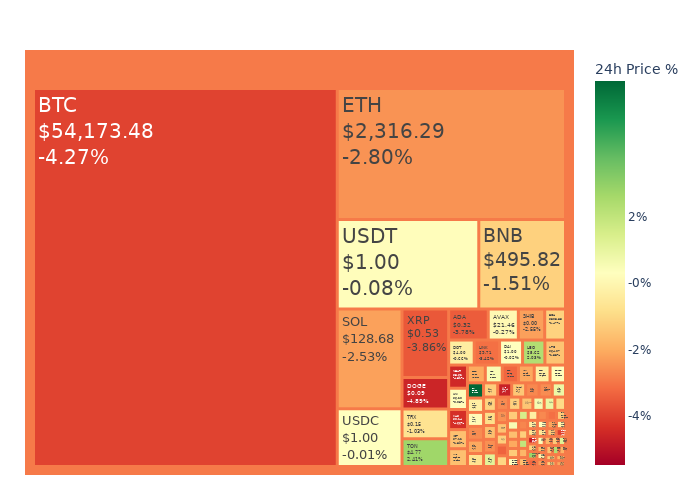

Market Update

News

Bitcoin Network Activity Hits Three-Year Low

In 2024, the Bitcoin network saw a notable decline in the number of active addresses, reaching a low not seen since 2021. The number of active addresses dropped to around 838,000. In August, miners' revenue dropped to a yearly low of $827 million, an 11% decrease from July. | Read More

MasterCard Launches Crypto Debit Card in Europe

MasterCard has taken a significant step in integrating cryptocurrencies into everyday transactions by launching a new crypto debit card in Europe. This, in partnership with Mercuryo, allows users to spend crypto directly from self-custodial wallets at over 100 million merchants worldwide. | Read More

Uniswap Labs Fined $175,000 by CFTC for Unauthorized Transactions

The U.S. CFTC has fined Uniswap Labs $175,000 for offering leveraged and margined retail commodity transactions in digital assets without proper authorization. Uniswap Labs was found to be in violation of the Commodity Exchange Act. The company offered leveraged and margined transactions in digital assets. | Read More

Morgan Stanley's Institutional Fund Has Exposure To Bitcoin with BlackRock ETF and MicroStrategy

Morgan Stanley's Institutional Fund has disclosed a 2.1% investment in BlackRock's Bitcoin ETF (IBIT). Additionally, the fund holds a 4% stake in MicroStrategy, a company known for its substantial Bitcoin holdings. This potentially indicates Morgan Stanley's confidence in Bitcoin long-term. | Read More