Solana ETF Filings Removed

Apple And Circle Partner To Advance Digital Finance, Uniswap Shares List Of Total Weekly Across Chains

Solana ETF filings have been removed from the Cboe website, which leads to the 19b-4 forms not being filed, due to the SEC's concerns about the potential "security" classification of Solana.

The SEC classified Solana, amongst other 12 tokens, as securities in June 2023. This classification might still stand given this delay or a no-go.

However, VanEck's S-1 Solana ETF registration still remains on the SEC's filing system. 21Shares' S-1 filing doesn't appear in search results anymore, but the link works.

SEC Commissioner Hester Pierce said more convincing would be needed before the Solana ETF could be approved. Other people, including Nate Geraci and Fred Rispoli also don’t seem to be expecting an approval soon.

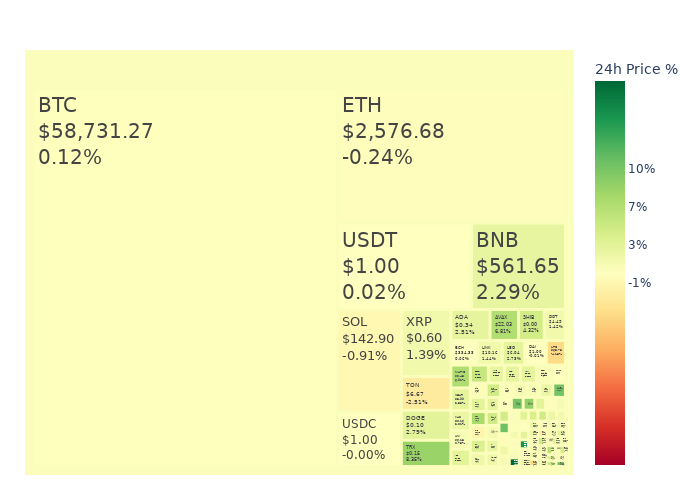

Market Update

News

Apple and Circle Partner For Digital Finance

Apple and Circle have announced a partnership that aims to advance the digital finance landscape. The primary goal of this partnership is to integrate cryptocurrencies into traditional financial systems, making transactions faster and more efficient. | Read More

Uniswap Labs Shares the List of Total Weekly Pools on Different Blockchains

Ethereum continues to dominate 118,820 new pools created in a week. Base has shown growth with 512,545 new pools. Polygon saw 2,989 new pools, Arbitrum had 1,866, and Optimism recorded 342 new pools. | Read More

Bitcoin Whale Loses $238M After Suspicious Transfer: ZackXBT

According to web3 investigator ZachXBT, the loss occurred through a suspicious transfer from a wallet containing over 4,064 Bitcoin, valued at around $238 million. The funds were subsequently distributed across several crypto platforms, including THORChain, KuCoin, and Railgun. | Read More

SuperRare Moves $1.8M in $RARE Tokens to Binance

SuperRare Treasury moved 7.5 million $RARE tokens, which are valued at approximately $1.8 million, to Binance. This transaction was facilitated by the liquidity provider GSR. The transfer has led to various speculations about SuperRare's strategic intentions. | Read More